- © White Panda SRLs 0

08/03/2025 Category: Businesses and Taxation

Every year, companies in Italy are required to comply with a number of tax and administrative obligations, whether they have actually operated or not. These obligations are crucial to maintain compliance with Italian regulations and to avoid penalties. Even companies that have not been active, but are still active with the Chamber of Commerce, cannot ignore these obligations.

The Annual Compliance for Companies

.Every year, companies must prepare annual financial statements, which include an income statement, balance sheet and notes to the financial statements. This document is essential for assessing the company's economic and financial situation. The preparation of the financial statements must comply with national or international accounting standards, depending on the type of company.

Once prepared, the financial statements must be approved by the shareholders' meeting. Approval must take place within the statutory deadline, which is usually 120 days after the end of the company's fiscal year. It is important that this deadline be met, as failure to do so may result in penalties.

After approval, the financial statements must be filed with the Business Registry of the Chamber of Commerce within 30 days of their approval. Filing is mandatory, even for companies that had no operations or activities in the reporting year. Failure to file financial statements may result in fines and possible ex officio removal of the company from the register.

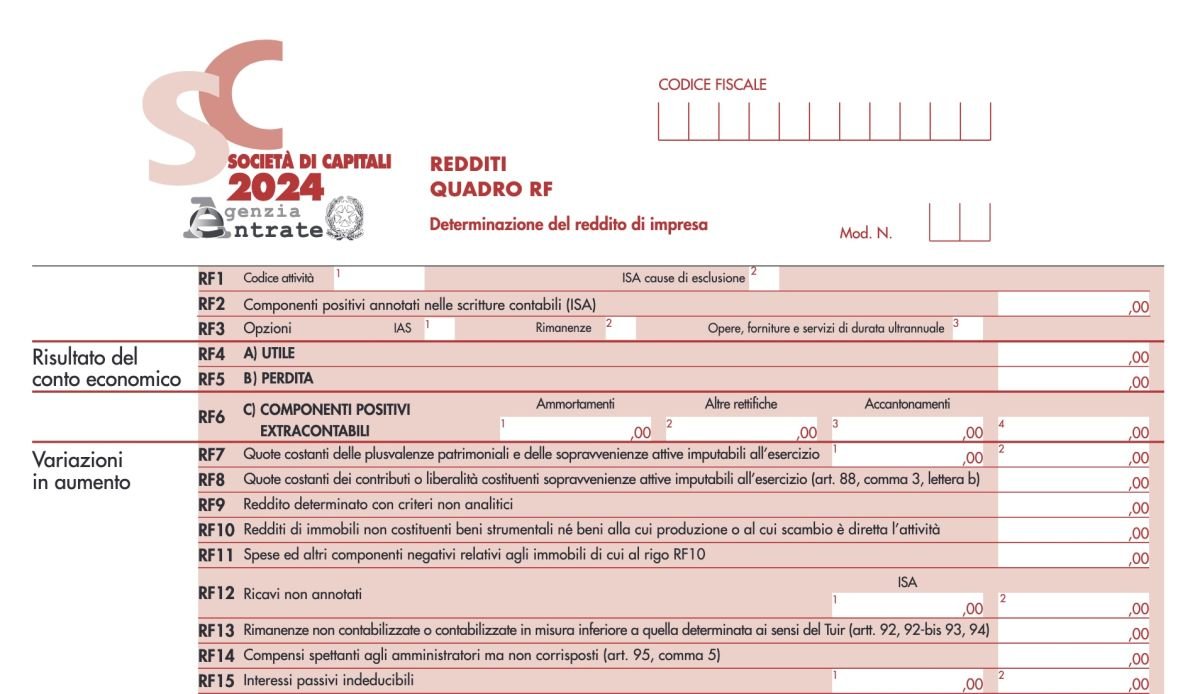

Companies are required to file an income tax return (Form Income SC), which includes the framework of fiscal management and disclosure of corporate income and expenses. This fulfillment is also mandatory for companies that have not been doing business, as long as they are still active with the Chamber of Commerce.

In addition to tax returns, companies must make tax payments, which include direct taxes (such as IRES) and indirect taxes (such as VAT, if applicable). Even if the company has not operated, tax payments are mandatory.

Even for companies that have had no operations, it is necessary to keep accounts in order and keep up-to-date tax records. The administrator must ensure that there are no irregularities in accounting management, even in the absence of business operations.

Non-operating companies must also keep social security and insurance obligations for their members and employees (if any) in order. These include the payment of INPS contributions and the updating of insurance positions.

The Penalties for Noncompliance

.Noncompliance with annual obligations under the law can result in heavy penalties. For example:

Even inactive companies are not exempt from penalties if they fail to fulfill their obligations, so it is crucial for all types of companies, active or not, to maintain their regular position.

Why Rely on a Professional

.The preparation, submission and filing of mandatory returns are complex and delicate operations. One mistake or oversight can have significant consequences for the company, including the payment of penalties or removal from the commercial register. For this reason, it is essential to rely on legal counsel or an experienced accountant to handle these obligations.

Professionals are able to:

In addition, relying on experts ensures that your business remains compliant with current regulations and reduces the risk of future legal or tax issues.

Conclusion

Even if your company has not operated during the year, annual compliance cannot be ignored. It is critical to maintain compliance with tax and administrative regulations to avoid penalties and other legal issues. For proper and timely handling of obligations, relying on an experienced professional is the best way to protect your company and ensure its regularity.

Contact us today for a personalized consultation to ensure that all of your company's annual obligations are completed correctly and on time.

Privacy Notice: We care about your privacy. For more details on how we handle your personal data, please see our Privacy Policy.

Contact us now!